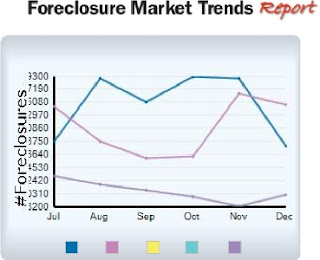

Foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 63,689 California properties in November, a 15 percent increase from October and 11 percent above the level reported for November 2010, according to the latest RealtyTrac® U.S. Foreclosure Market Report.

The Golden State maintained its position as the state with the second highest foreclosure rate, reporting one in every 211 California housing units with a foreclosure filing in November — nearly three times the national average.

California continues to lead the nation in terms of total properties with foreclosure filings by a large margin. Second ranked Florida reported 24,739 properties with foreclosure filings during the month. Third place was Michigan, where 13,777 properties with foreclosure filings were reported. Illinois had the fourth highest total, reporting 12,398 properties with foreclosure filings while Georgia took fifth place, tallying 12,327 properties with foreclosure filings.

The remaining states that make up the nation’s top 10 in November include Arizona (10,766), Ohio (10,184), Texas (10,124), Nevada (6,512) and Wisconsin (4,382). The top 10 accounted for 75 percent of the nation’s total foreclosure activity for the month.

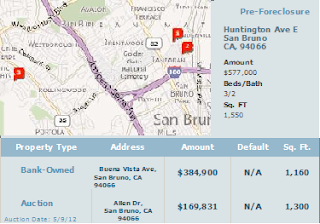

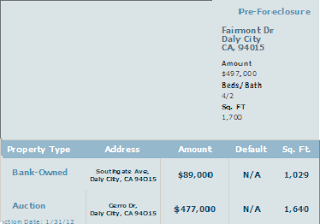

San Bernardino County posts top foreclosure rate in the state for November

One in every 119 housing units in San Bernardino County had a foreclosure filing in November — 4.9 times the national average and 1.8 times the state average — the highest foreclosure rate of all California counties for the month. San Joaquin County had the second highest rate of one in every 120 housing units with a foreclosure filing during the month — 4.8 times the national average and 1.8 times the state average. Riverside County had the third highest rate of one in every 130 housing units with a foreclosure filing during the month — 4.5 times the national average and 1.6 times the state average.

Southern California stays atop the foreclosure heap in November

Four Southern California counties topped the list for highest foreclosure totals in the state for November. Los Angeles County continued to lead all counties by a large margin, reporting 13,276 properties with foreclosure filings for the month. Riverside County remained second highest, reporting 5,969 properties with foreclosure filings. San Bernardino County was third once again, reporting 5,770 properties with foreclosure filings. Fourth highest was San Diego County, recording 4,484 properties with foreclosure filings. Sacramento County was fifth highest, tallying 3,797 properties with foreclosure filings for the month.

State the nation’s largest contributor to total foreclosure activity in November

California accounted for 28 percent of the 224,394 properties with foreclosure filings reported nationwide in November. Total U.S. activity decreased by 3 percent from October and was down over 14 percent from the level reported in November 2010. One in every 579 U.S. housing units received a foreclosure filing during the month.

“Despite a seasonal slowdown similar to what we’ve seen in each of the past four years, November’s numbers suggest a new set of incoming foreclosure waves, many of which may roll into the market as REOs or

short sales sometime early next year,” said James Saccacio, co-founder of RealtyTrac. “Overall foreclosure activity is down 14 percent from a year ago, the smallest annual decrease over the past 12 months, and some bellwether states such as California, Arizona and Massachusetts actually posted year-over-year increases in foreclosure activity in November.